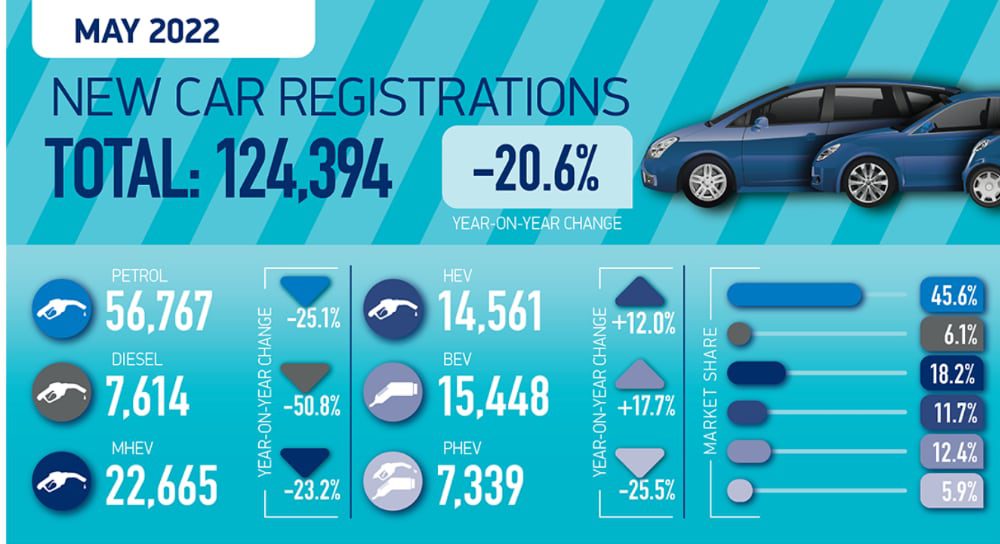

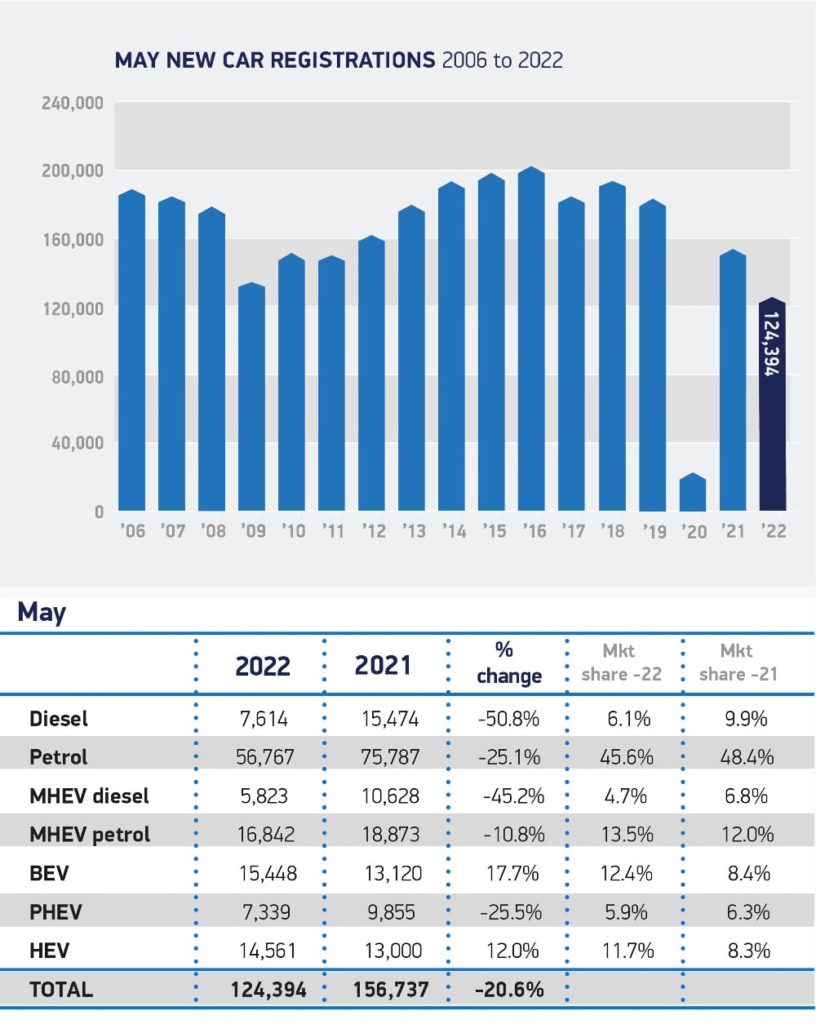

New UK car registrations fell -20.6% to 124,394 units in the second weakest May since 1992, after the 2020 pandemic-hit market, as supply shortages continued to hamper new purchases and the fulfilment of existing orders, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). The decline, compared with the first full month of reopened showrooms in May last year, demonstrates the impact of continued global supply chain disruptions, with the market -30% below the 2019 pre-pandemic level despite strong order books.

While private consumer purchases fell -10.3%, their market share increased year-on-year by 6.1 percentage points to 53%, in part due to manufacturers striving to fulfil deliveries – particularly of electric vehicles – to private buyers, with the commensurate effect on the business and large fleet sectors, which now comprise 46.8% of the market.

Despite the myriad challenges affecting the industry and a high level of market distortion due to restricted supply of all vehicle types and technologies, manufacturers have worked hard to sustain progress towards the decarbonisation of road transport and the delivery of UK’s ambitious net zero targets. May saw registrations of battery electric vehicles (BEVs) rise by 17.7%, representing one in eight new cars joining the road last month. Plug-in hybrids declined -25.5%, while hybrids were up 12.0%, meaning deliveries of electrified vehicles accounted for three in 10 new cars.

Superminis continued to be the most sought-after segment by British motorists, making up 32.7% of registrations in the month, despite their registrations falling -16.4% to 40,667 units, followed by dual purpose, which accounted for 28.9% of the market even after a -14.1% fall in volumes. The small volume luxury car segment was the only area of growth, up 16.8%, to 369 units.

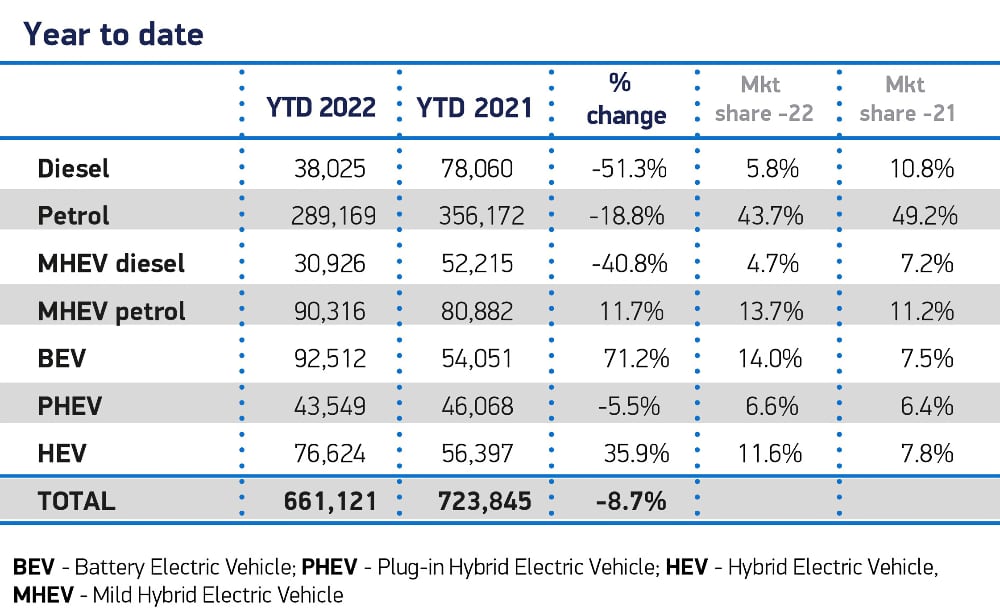

The supply chain challenge has contributed to an overall market decline in the year to date of -8.7%, equivalent to 62,724 fewer units. This is -40.% below the five-year average recorded from January to May, as the new car market continues to struggle to emerge from the impact of the pandemic.

As you can see the Diesel market is evorapating with over 50% decline compared to last year and now represents 5.8% of the new car market. Full electric cars now represent three times the Diesel share at over 14% with over 92,000 cars delivered so far this year.

Source: SMMT Data