We are a big fan of Hindenburg Research ever since they uncovered the fun, games and fraud at Nikola.

In September 2020 Hindenburg published a report claiming that Nikola is an intricate fraud built on dozens of lies over the course of its Founder and Executive Chairman Trevor Milton’s career. One of the most impactful claims was in the face of growing skepticism over the functionality of its truck, Nikola staged a video called “Nikola One in Motion” which showed the semi-truck cruising on a road at a high rate of speed. Our investigation of the site and text messages from a former employee reveal that the video was an elaborate ruse—Nikola had the truck towed to the top of a hill on a remote stretch of road and simply filmed it rolling down the hill.

Now we have a claim against a Canadian Lithium Miner – Standard lithium. Hindenburg suggest that the company is Stock Promotion Scheme Fuelled by EV Lithium Hype.

The Canadian stock market has plenty of small miners of all types that claim fantastic returns and special propriety technology to transform their industry. There are also a host of stock pushing firms that pump out bogus claims and inflated new stories. Most companies are in the penny stock league and most stay there.

With the ramp in EV sales the market has looked at Lithium miners and producers as potential big winners. There are plenty of players in the Lithium space to choose from and it can be hard to sort the wheat from the chaff.

Big and Growing Market

According to the latest figures from the US Geological Survey (USGS), global lithium production in 2019 stood at 77,000 tonnes.

With battery manufacturing expected to accelerate over the coming years, particularly as electric vehicles become more prevalent in key markets seeking to decarbonise, interest in the metal will continue to grow, and analysts expect worldwide demand will more than double by 2024.

The two largest players are:

- Jiangxi Ganfeng Lithium Co. Ltd: Based in China with a market cap of $38.6bn. Jiangxi is primarily involved in the research, development, production, and sales of lithium products. The company sells lithium in both its metal form and compounds, including fluorides, chlorides, and others.Jiangxi Ganfeng is the largest lithium metal producer in the world, while its lithium compound capacity ranks third worldwide and first in China. The firm holds lithium resources across Australia, Argentina, and Mexico and has over 4,844 employees. It reported a revenue of 2020 $839.26 m in 2020, almost double the $432.11 m it reported in 2016.

- Albemarle: Based in Charlotte, North Carolina, with a market cap of $26.8bn. The company operates 3 divisions: lithium, bromine specialties, and catalysts. Founded in 1994, the firm has grown to establish itself as the second-largest lithium miner in the world, with a revenue of $3.128bn in 2020. With over 5,000 employees in 100 countries worldwide, Albemarle, as of 2020, was the largest provider of lithium for electric vehicle batteries.

These are large well established companies and there are plenty of smaller operators such as Orocobre from Australia.Standar

Orocobre is a mineral resource and exploration company, focusing on the development of lithium-potassium brine projects. It claims to be on of the world’s largest and lowest cost lithium chemicals producers. The company’s flagship project is the Salar de Olaroz lithium-potassium brine project located in the province of Jujuy in northwest Argentina. This project is in partnership with Toyota Tsusho Corporation (TTC) and Jujuy Energía y Minería Sociedad del Estado (JEMSE). The project is estimated to have a resource base of 6.4 million tons of lithium carbonate equivalent with an estimated 40-year mine life. With 300 staff and $90 Million in revenue.

Standard Lithium – True or False?

This then brings us to Standard Lithium. https://www.standardlithium.com

Key points raised by Hindenburg claim:

- Standard Lithium is a zero-revenue mining company that uplisted to the NYSE in July 2021 with a fantastic-sounding story of being a first mover in direct-lithium-extraction (DLE), a technology that aims to revolutionize lithium mining.

- Standard’s CEO Robert Mintak has been involved with at least 9 publicly traded companies. On average, shares of these companies have fallen ~97%. Of the 9 companies, 5 have been delisted, several have faced regulatory scrutiny, none operate profitably, and at least 8 used paid stock promotion.

- Robert Mintak’s role immediately prior to Standard Lithium was as CEO of Pure Energy Minerals, another lithium company that, like Standard Lithium, touted proprietary DLE technology. Pure Energy used extensive stock promotion but failed to commercialize DLE. Its stock crashed ~98%, with executives moving on to Standard Lithium.

- Standard Lithium’s CEO, COO, Chairman, and VP of Exploration all came from Pure Energy Minerals. We show that Standard’s executives and board also have ties to companies whose stocks spiked on the back of paid stock promotion before ultimately plummeting.

- Mintak previously worked at a 3-person stock promotion firm based out of a Regus rental office. His partner at the firm is currently facing a B.C. Securities Commission investigation into allegations of undisclosed stock promotion at a different failed lithium mining company.

- Standard Lithium appears to us to be a regurgitation of Mintak’s prior company, Pure Energy Minerals, using the same Vancouver stock playbook as Mintak’s numerous other failed ventures.

- Standard Lithium has used a vast network of 15+ stock promotion outfits. Since going public, the company has spent over C$5 million on “advertising and investor relations” compared to about C$1.7 million on R&D. In fiscal 2021, its R&D budget dropped to zero.

- Around the time of the Standard Lithium’s reverse merger to go public in 2016, it executed 2 opaque land deals resulting in almost 21 million shares (worth ~$152 million today) going to unnamed beneficiaries.

- Both land deals appear to have been undisclosed related party transactions. The first was with a newly formed entity based at the same address as Standard’s merger partner. The former President of Standard’s merger partner, associated with the deal, was later charged by the SEC over allegations of helping insiders secretly dump large quantities of stock in at least 45 companies through the use of opaque entities.

- The second land deal was with a newly formed entity incorporated by the law firm of a then-Standard Lithium director. The now-former director was later suspended from practicing law for 2 months for misappropriating client funds and is reportedly subject to a “broad” B.C. Law Society investigation into “entities and individuals who were apparently involved in market manipulations”.

- Robert Mintak’s prior company, Pure Energy Minerals, also executed a questionable land option deal through the same firm that vended the questionable land option deal to Standard Lithium.

- Standard claims its proprietary “LiSTR” technology differentiates it from other lithium hopefuls. LiSTR is based on three patent applications it purchased in 2018 from an apparent one-man engineering shop. Two of the applications have already been rejected as “unpatentable” by the USPTO.

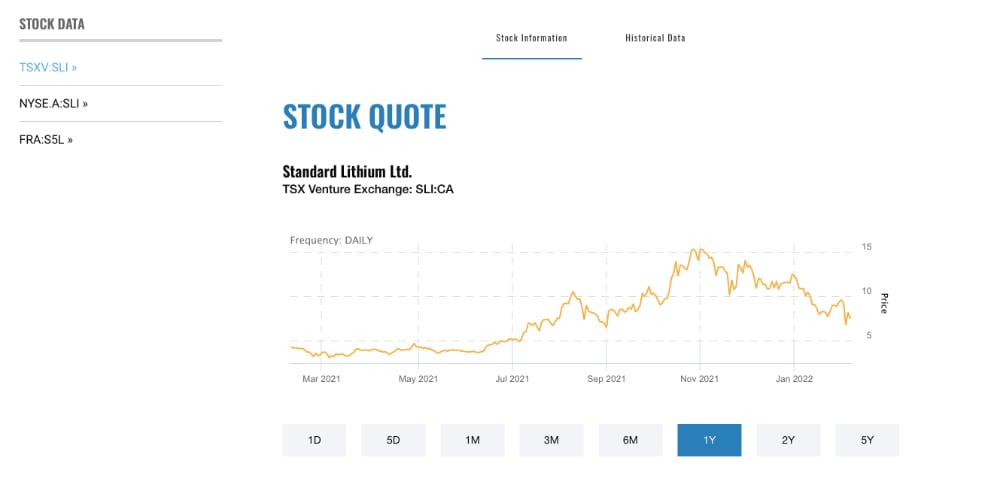

Based on the track record of Hindenburg and the suspect nature of Canadian miners we have shorted the stock. The graph below shows the last year: From $4 to $15 and now back to $7. We hope for less than $1.