In a surprise move Tesla UK introduced a new Model 3 variant for UK business customers.

In the UK business customer have strong incentives to go electric. The value of the vehicle can be written down as cast rather than an expense, making a Tesla a great way to eat profit. And all company car drivers are heavily taxed unless they select an EV where the company car tax is just 2% rather than the around 30% for a BMW 3 or similar. – This alone is a huge saving.

Tesla announced that it is making a new version of the Model 3 with the Long Range battery pack and a single RWD motor, but it’s only available to businesses in the UK.

Currently, Tesla only sells three versions of the Model 3:

- Standard Range RWD

- Long Range AWD

- Performance AWD

But now the automaker announced that it is a making a new version just for businesses.

Karen Bowen, senior key account manager at Tesla, announced on LinkedIn this week:

To accelerate the electrification of Europe’s B2B fleet, we are introducing a new Model 3 variant that caters to the needs of our commercial customers. Model 3 Long Range Rear-Wheel Drive combines a segment-leading range of 394 miles (WLTP) with highest charging convenience, at an entry-level price point from £46,990.

That’s a Model 3 with a Long Range battery pack, but it only has a single rear-wheel-drive motor instead of two motors like the current Model 3 Long Range.

At £46,990, it’s £4,000 more expensive than the base Standard Range and £4,000 cheaper than the regular Long Range AWD.

Leasing Deals?

We receive plenty of emails from car leasing firms and expect these to include the new version soon.

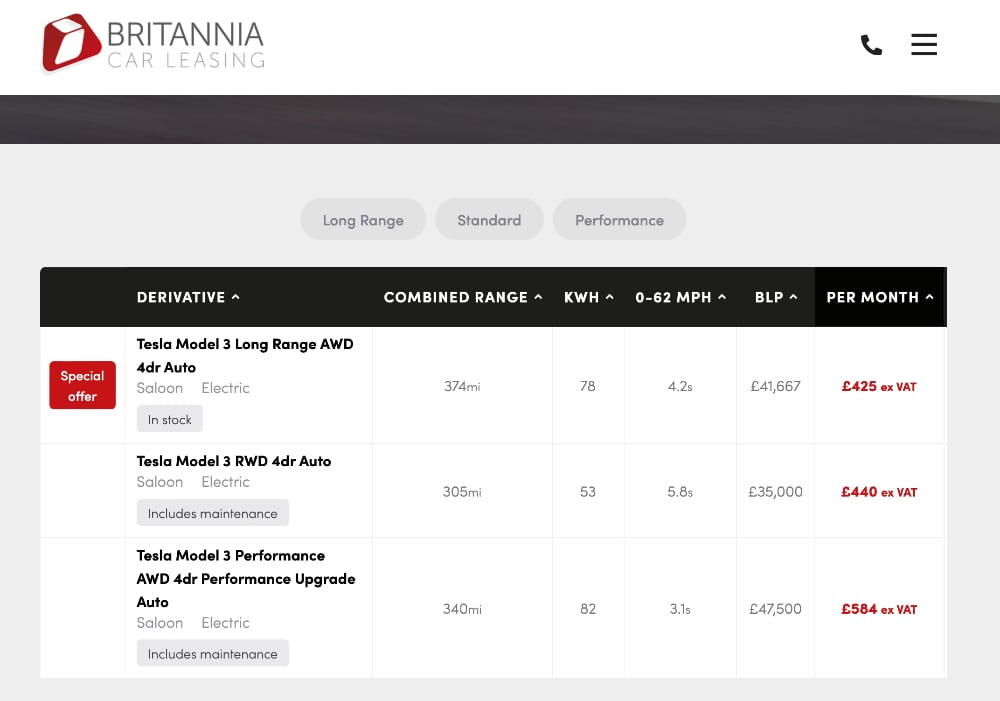

The current offers from Britannia are shown below.

Right Hand Drive UK model 3 are still produced in China rather than Germany so we could see a similar model in China.

And will there be an similar model Y long range for business users at some point?