Here is the UK were are heading for an energy crisis with consumer’s bill about to jump by 75% as the price cap is reset closer to reality in April. This is mainly due to our reliance on purchasing natural gas on the spot market to feed our power stations to make electricity and gas that is pumped into millions of homes for heating and the cost of gas has increased significantly over the last 6 months. We have started to find out the hard way that wind and solar are pitiful in winter especially when we have no meaningful wind for days on end.

Let’s look at the bigger picture: – What has Europe done?

The UK and the European energy crisis is poised to go from very bad to unimaginably worse. While all eyes are on Ukraine and Russia, Europe’s energy woes are largely self-made, not due to outside forces.

Europe has made its own bed, disassembling dispatchable fuel diversity by closing well-operating coal and nuclear power plants. In doing so it has deepened its already troubling reliance on an insecure and volatile natural gas market dominated by Vladimir Putin. Europe is, in fact, more dependent on Russian gas today than it was when Russia annexed Crimea in 2014.

Meghan O’Sullivan, the director of the Geopolitics of Energy Project at Harvard University’s Kennedy School, told The Wall Street Journal

“For the foreseeable future, Europe will remain dependent—and possibly as dependent as ever—on Russian gas.”

Meghan O’Sullivan

Europe couldn’t have picked a worse bridge to its idealized energy future, and now European consumers are paying a galling price. In the 4th quarter of 2021, the International Energy Agency reported that average European wholesale electricity prices were more than four times their 2015-2020 average. Households are set to pay an average of 54% more for energy than they did two years ago. These are the prices before potential conflict erupts in Ukraine and an already tight European gas market is turned completely upside down.

In the U.K., higher energy prices are poised to push an estimated 2 million additional households into fuel poverty, taking the total to 6 million, the highest level of fuel poverty in more than 25 years. What’s happening in Britain is playing out across the continent. And there’s growing acknowledgement that it didn’t have to be this way.

Europe’s renewable and natural gas obsession has paved the way for the loss of an astounding amount of coal and nuclear power capacity. As of March 2021, more than half of Europe’s coal capacity that was operating in 2016 had been retired or been scheduled for retirement by 2030. In the U.K., coal generation met 40% of power demand a decade ago – just a handful of coal plants are left on the grid today. Nuclear retirements and phaseouts – notably the nuclear phaseout in Germany – continue despite consumers drowning under soaring power and gas prices. Germany closed half its remaining nuclear power capacity in 2021 and its remaining three plants are scheduled for retirement this year.

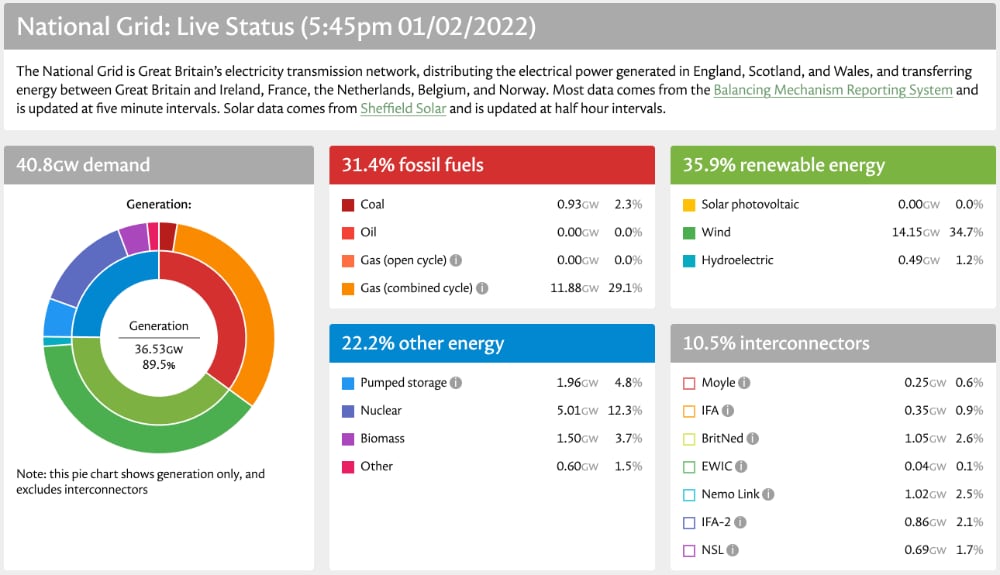

For those interested you can see the real time UK electricity generation power sources on the Nation Grid feed: See Live data.

Current production – 40Gw at the time of writing 6PM Feb 1st a dark & stormy night – shows: Coal 2%, Gas 29% Solar 0%, Wind 35%, Nuclear 12%.

Europe has wedged itself between a rock and a hard place. It’s stuck paying exorbitant prices for natural gas, and massive investments made in renewable power have left the E.U. in a continuous boom-bust cycle of weather-driven generation. Unfortunately, some of the coldest weeks are also those with the least wind and daylight.

Despite ongoing efforts to push remaining coal capacity aside, coal is playing an essential role in navigating the crisis. As Bloomberg reported just this week, “Coal will play a vital role in helping to keep the lights on in Europe this winter… The latest example of the fuel’s importance came on Monday as U.K.’s usage peaked at its highest level since March to help plug a gap in supplies.”

In Germany, coal also showed its importance in November and December, with power generation rising 16% from a year earlier. And in Spain, a coal plant forced into retirement three years ago has been given new life to keep the lights on and reduce gas consumption.

There’s no getting around it. Europe’s energy crisis is a failure of policy and a clear case study of the danger of disassembling the stability that comes with fuel diversity in a misguided, rushed and irresponsible approach to the energy transition. The warning for American energy and climate policy is impossible to miss. Whether policymakers learn the right lessons remains to be seen.

Unfortunately it is hard to see a solution to this mess any time soon. All the options require years to make any significant impact: We could – Reduce consumption by better insulation. We have a huge number of badly built and badly insulated homes and offices, improving them would help but take years to have any impact. Add more Wind power: – This is happening but does not help on those hazy days of winter and summer with little wind. Add solar. We in the UK are just so far from the Equator it always going to be a modest benefit. Build some more nuclear power stations. – Our best bet is over budget and late. See Hinkely Point C with a plan to come on line in 2026. However as we add one new station we are expected to close half the current plants by 2025.

A report in the House of Lords in December claims “Almost half of the UK’s current nuclear capacity is due to be decommission by 2025 and only one new plant, Hinkley Point C, is currently under construction. If no other new nuclear power stations are built, the UK’s nuclear capacity in 2050 will be a third of what it is today.”

It’s not looking good.