Government borrowing costs soar

This week has not been a great week for the Government with a raft of pointless arguments about pointless public inquiries and Musk calling people names but much more importantly the Bond market has worked up to the sorry state of the UK economy.

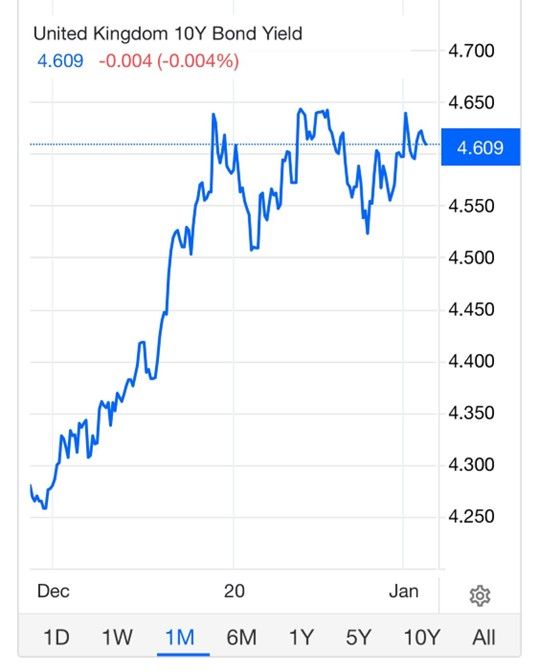

Government borrowing costs higher now than at any time during the Truss premiership.

This shows that’s the government’s anti-business tax policies do have rapid consequences. I’ve heard a lot of talk about how Truss “trashed the economy” after her mini budget because of the effect on borrowing costs, but we are now in a worse position. See chart below.

As a side it seems that Liz Truss has sent a “cease and desist” letter to Sir Keir Starmer demanding he stop saying she “crashed the economy”.

Her lawyers argue the claim made repeatedly by Sir Keir is “false and defamatory”, and harmed her politically in the run-up to losing her South West Norfolk seat in the general election.

Business confidence is low as they have to grapple with substantial increases in employment costs (both National Insurance and minimum wage) and this has affected business investment. GDP growth is at zero at best and prospects do not look great.

But more bad

The pound fell by 0.9% to $1.226 against the dollar on Thursday, while borrowing costs jumped.

Sterling typically rises when borrowing costs increase but economists said wider concerns about the strength of the UK economy had driven it lower.

This sort of activity is to be expected only in highly dodgy third world countries – Argentina comes to mind.

This reinforces my view that government must look beyond just taxing more and borrowing more (especially as that is now much more expensive) and should instead examine public sector efficiency and slash the number of public servants. We cannot afford to live beyond our means.