We uncovered a new and relatively informative website. The European Commissions view of alternative vehicles statistics at the European Alternative Fuels Observatory (EAFO) website. Eafo.eu

The site details sales of BEV and PHEV that Battery and Plug-In Hybrid electric cars by country by year and seems to be updated monthly.

The site is an European Commission funded initiative which provides open and free information, amongst others to support Member States with the implementation of EU Directive 2014/94 on the deployment of alternative fuels infrastructure.

What has sold well so far in 2016?

European sales of PEV, electric cars and plug-in hybrids totaled 46,957 units between January and March 2016, giving growth of 29 percent over the same period last year.

The total of 23,160 sales pushed plug-in cars past the 1-percent barrier in terms of total European new-car sales.

In the midst of that push, there was also a lead change among battery-electric cars.

The Renault Zoe had led European electric-car sales in January and February, but it was surpassed by its corporate cousin, the Nissan Leaf, in March.

Electric Car Sales

Nissan’s electric car racked up 6,168 sales in the first three months of 2016, giving it 13.1 percent of the market.

The Renault Zoe was quite close behind, however, with 5,578 sales.

The Tesla Model S took third place, with 3,378 sales.

Tesla apparently made up some ground in March, as the Model S had been ranked fourth for the January-February period.

Further behind were two German electric cars—the Volkswagen e-Golf with 2,228 sales, and the BMW i3 with 1,567 sales.

They were followed by the Kia Soul EV (1,065 sales) and Mercedes-Benz B250e (740 sales).

The bottom three cars in the top 10 remained the Volkswagen e-Up and the Peugeot iOn and Citroën C-Zero.

The e-Up, which racked up 615 sales, is an electric version of the VW Up city car.

The Peugeot (557 sales) and Citroën (423 sales) are both re-badged versions of the Mitsubishi i-MiEV.

Plug-in hybrids: Mitsubishi Outlander rules

The Mitsubishi Outlander Plug-In Hybrid crossover remained the best-selling plug-in hybrid in Europe through the end of March.

It achieved 6,159 sales in the first three months of 2016, accounting for 13.1 percent of the market.

That put the Mitsubishi well ahead of the second-place Volkswagen Golf GTE, which only reached 2,979 sales.

The Volvo XC90 T8 took third place, with 2,661 sales.

It was followed by the Audi A3 Sportback e-tron (2,252 sales) and Volkswagen Passat GTE (1,593 sales).

Further down the list were the BMW X5 xDrive 40e (1,576 sales) and Mercedes-Benz C350e (1,275 sales).

Closer to the bottom was the BMW i3 REx, (range extender, or small engine) which is considered a plug-in hybrid for the purposes of the EAFO tally.

The range-extended i3 model achieved just 1,030 sales—far lower than its all-electric counterpart.

In ninth place was Volvo’s second plug-in hybrid, the V60 Twin Engine, with 902 sales.

Finally, the BMW 225xe Active Tourer closed out the top 10 plug-in hybrids with 770 sales.

Interesting the sales volumes for the best setting BEV and PHEV are very similar with 6,168 Leafs compared to 6,159 Outlanders. Together the Leaf and Outlander comprise over a quarter of all alternative fuel vehicles sales in Europe.

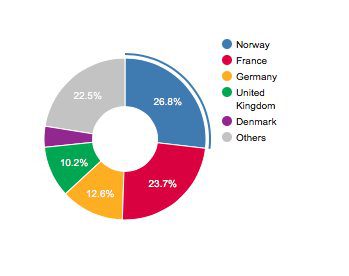

Pure electric cars are focused on Norway and France with 26% and 24% of the market with Germany with 12% and the UK with 10%.

For Plug In Hybrids the Netherlands commands 35% of the market with the UK second at 18% with Germany and Norway at 11% each.

| Ranking | Make | Model | YTD 2016 | Share PEV market |

| 1 | Nissan | Leaf | 6168 | 13,1% |

| 2 | Renault | Zoe | 5578 | 11,9% |

| 3 | Tesla | Model S | 3378 | 7,2% |

| 4 | Volkswagen | e-Golf | 2228 | 4,7% |

| 5 | BMW | i3 | 1567 | 3,3% |

| 6 | Kia | Soul EV | 1065 | 2,3% |

| 7 | Mercedes | B250e | 740 | 1,6% |

| 8 | Volkswagen | e-Up! | 615 | 1,3% |

| 9 | Peugeot | iOn | 557 | 1,2% |

| 10 | Citroen | C-Zero | 423 | 0,9% |

| Others | / | / | 852 | 1,8% |

| BEV Total | 23171 | |||

| Ranking | Make | Model | YTD 2016 | Share PEV market |

| 1 | Mitsubishi | Outlander PHEV | 6159 | 13,1% |

| 2 | Volkswagen | Golf GTE | 2979 | 6,3% |

| 3 | Volvo | XC90 PHEV | 2661 | 5,7% |

| 4 | Audi | A3 e-Tron | 2252 | 4,8% |

| 5 | Volkswagen | Passat GTE | 1593 | 3,4% |

| 6 | BMW | X5 40e | 1576 | 3,4% |

| 7 | Mercedes | C350e | 1275 | 2,7% |

| 8 | BMW | i3 Rex | 1030 | 2,2% |

| 9 | Volvo | V60 PHEV | 902 | 1,9% |

| 10 | BMW | 225xe Active Tourer | 770 | 1,6% |

| Others | / | / | 2589 | 5,5% |

| PHEV Total | 23786 | |||

| Total PEV | 46957 |