JATO reports EV revolution hits new milestone as Tesla Model 3 becomes Europe’s best-selling car in September

September was another significant month for Europe’s automotive industry, as new car registrations fell by 25% to just 964,800 units. Dealers continue to face issues with the availability of new cars due to the chip shortage. As a result, unwilling to wait more than a year for a new car, many consumers have turned to the used car market.

Year-to-date, Europe’s 26 markets continued to outperform in comparison to 2020, however the gap has narrowed. By the end of the first half of the year, total registrations were 27% higher than in H1 2020. Results through September show that this gap has narrowed to just 7%.

The EV surge continues

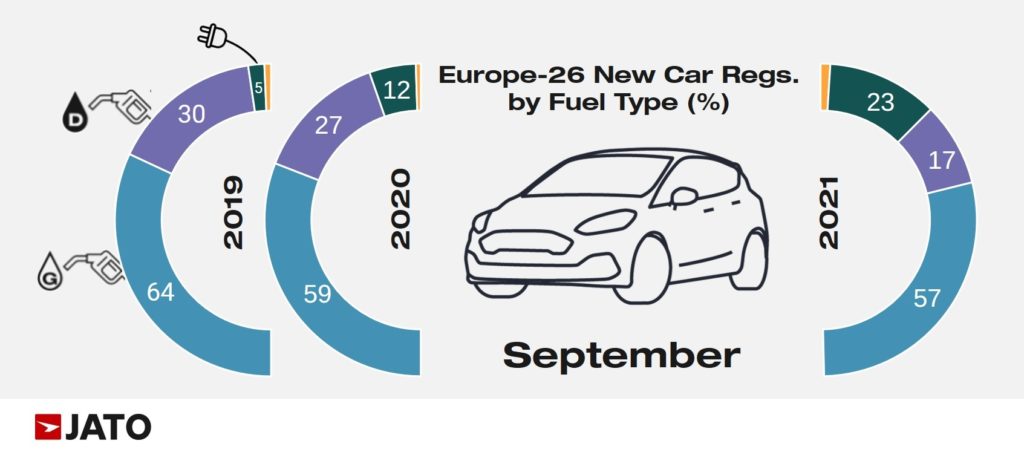

OEMs with a large offering of pure electric and plug-in hybrid cars have been less impacted by the current crisis, as European consumers continue to take advantage of the various incentives and subsidies available for these vehicles. In stark contrast, both the chip shortage and the growing severity of the climate crisis has caused diesel vehicle sales to plummet. In September, low emission vehicles posted a monthly growth of 44%, to 221,500 units, while the registrations of diesels decreased by 51%, to 167,000 units.

Before the pandemic, there were 10.3 new diesel cars registered for every electric or plug-in hybrid vehicle. Today, that ratio has decreased to just 1.3. Felipe Munoz, Global Analyst at JATO Dynamics, commented: “Shifts of this magnitude are rare, and a number of factors have contributed to the current state of play. In addition to incentives, OEMs have enhanced their offering with more models and better deals, and many are shifting their limited supply of semiconductors to the production of EVs, instead of ICE vehicles.”

As a result of the EV boom, the Tesla Model 3 topped the European model rankings in September, with 24,600 registered units – a 2.6% market share. This is both first time that an EV has led the market and the first time that a vehicle manufactured outside of Europe has occupied the top spot.

The strong performance of the Model 3 is in part explained by Tesla’s intensive end-of-quarter sales push. September has historically been a strong month for the US manufacturer’s registration results in Europe, on average accounting for 68% of its third quarter deliveries since 2018. Last month, registrations accounted for 74% of third quarter volume. Since its’ entry to the European market, the Model Y has also performed well, securing second position in the BEV ranking. This is before the new Berlin factory is ready for production of 3 and Y models. As this ramps local production and so reduces the imports from China it will also cut the delivery time by 2 months and save the cost of shipping cars thousands on KMs by sea.

Due to the success of these two models, Tesla leads the BEV market with a share of 24%, ahead of the Volkswagen Group with 22%, Stellantis with 13%, and Hyundai-Kia with almost 11%. Tesla also registered more new cars than established brands including Fiat, Nissan or Seat.

SUVs on track for 50% market share

Last month 46.5% of the passenger cars registered in Europe were SUVs – the highest ever monthly market share for the segment. Despite the current crisis faced by OEMs, these vehicles continue to gain traction thanks to the arrival of EV and plug-in hybrid alternatives, such as Tesla’s Model Y. Munoz commented: “If the trend continues, the roads of Europe could soon look similar to the US, where more than half of the new cars sold are SUVs.”

This segment was led by the Volkswagen Group, Stellantis and Hyundai-Kia, and the big market share winners during the month were the Korean maker, Tesla and Volkswagen Group.

Musk has claimed a number of times that he expects the Model Y to be the best selling car in the world next year. If the EC falls more in love with the SUV as the Americans have done then the Y may become very common on our roads.

Source: JATO.