Highlights

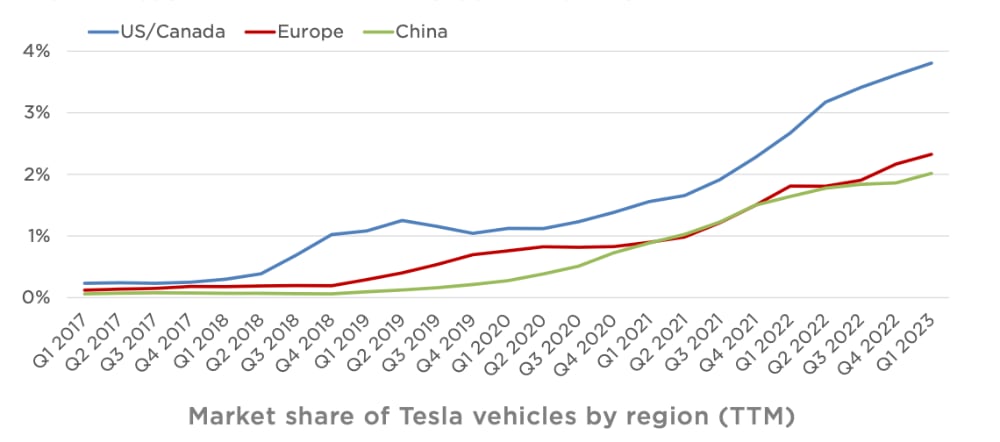

Another strong quarter for Tesla with continued sales growth of cars with total production of 479,700 units giving 86% YoY growth.

Total revenues came in at $24.93B with $21.3B from automative sales giving YoY growth of 47%. With the price cuts margins slipped a tad to 9.6% down from 16% in Q4 last year. Still a margin that most other auto companies can only dream off.

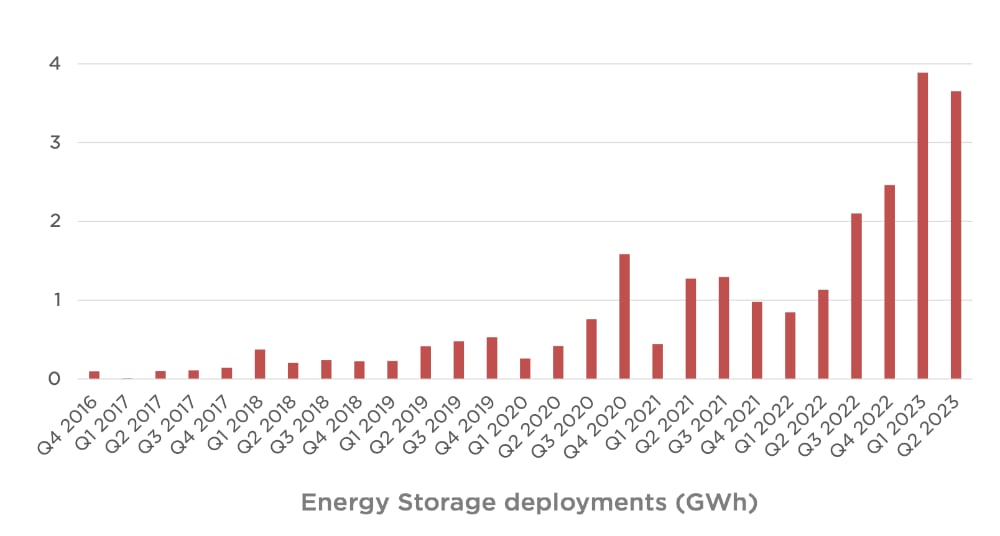

Energy products grew at 222% YoY to deploy 3,653 MWh of batteries but down slightly from the record 3.889 MWh of Q1 production.

Highlights from announcement:

VEHICLE CAPACITY

In Q2, we produced a record number of vehicles, thanks to ongoing ramps of our new factories as well as strong performance of Shanghai and Fremont. We remain committed to smoothing deliveries throughout the quarter by reducing the percentage of vehicles delivered in the 3rd month. Vehicles in-transit, test-drive and display vehicles account for a substantive majority of our total days of supply.

US: California, Nevada and Texas

At Gigafactory Texas, in addition to the continued success of the Model Y ramp, we are also working on equipment installation for Cybertruck production, which remains on track for initial deliveries this year. We have made notable progress on yield improvement of our 4680 cell production lines. We continue building capacity for cathode production and lithium refining in the U.S.

China: Shanghai

Since our Shanghai factory has been successfully running near full capacity for rate. Gigafactory Shanghai remains our main export hub.

Europe: Berlin-Brandenburg

Our factory in Germany produced standard range Model Y vehicles in Q2 for the first time. Building off momentum from its success in Q1, Model Y was the best-selling vehicle of any kind in Europe year-to-date (based on the latest available data as of May).

Energy Storage

Energy storage deployments increased by 222% YoY in Q2 to 3.7 GWh, another strong quarter due to the ongoing ramp of our first dedicated Megapack factory (Megafactory) in Lathrop, CA. The ramp of this 40 GWh Megafactory – the first of many – has been successful with still more room to reach full capacity. While energy storage deployment rate can be volatile due to project timing, production rate improved further sequentially in Q2.

Solar

Solar deployments remained roughly flat sequentially at 66 MW, declining YoY, predominantly due to a high interest rate environment that is causing postponement of solar purchasing industry-wide.