Q4 Results Fall Short

In the quarter, Tesla generated earnings per share (EPS) of $0.71, falling short of the consensus estimate of $0.74.

Meanwhile, despite a 3.5% year-on-year (YoY) increase, the $25.2bn revenue was $590m below the analysts’ expectations.

The company built 494,989 vehicles — a 13% YoY increase — and delivered 484,507 vehicles, a 20% YoY increase, in Q4.

While this may sound impressive, production numbers were actually down quarter on quarter. This sequential decline was attributed to planned factory downtimes for upgrades.

For the full year, vehicle deliveries grew by 38% YoY to 1.81m. Production jumped by 35% to 1.85m vehicles.

Stock falls 10% at the open.

Highlights

In 2023, we delivered over 1.2 million Model Ys, making it the best-selling vehicle, of any kind, globally. For a long time, many doubted the viability of EVs. Today, the best-selling vehicle on the planet is an EV.

Free cash flow remained strong in 2023 at $4.4B, even as we focused on future growth projects with our highest capital expenditures and R&D expenses in company history.

Energy storage deployments reached 14.7 GWh in 2023, more than double compared to the previous year, while Energy Generation and Storage business profits nearly quadrupled in 2023. Gross profit of our Services & Other business increased from a ~$500M loss in 2019 to a ~$500M profit in 2023.

Cost of goods sold per vehicle5 declined sequentially in Q4. Our team remains focused on growing our output, investing in our future growth and finding additional cost efficiencies in 2024.

In late December, we started rolling out V12 of FSD Beta6. Trained on data from a fleet of over a million vehicles, this system uses AI to influence vehicle controls (steering wheel, pedals, indicators, etc.) instead of hard-coding every driving behavior. V12 marks a new era in the path to full autonomy.

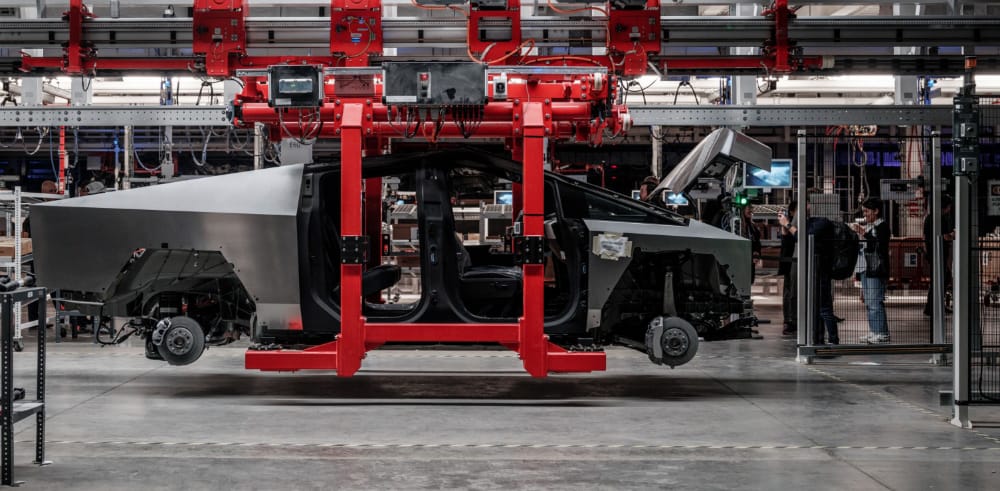

We are focused on bringing the next generation platform to market as quickly as we can, with the plan to start production at Gigafactory Texas. This platform will revolutionize how vehicles are manufactured.

Tesla Revenues

Q4 2022 and Q4 2023 - Revenues in $ millions

Loading..........

The Data is Not Available

The good news is that it Tesla its goal of delivering 1.8 million electric vehicles. However growth has stalled with sales and revenue up on slightly. Tesla shares have fallen steeply in early trading.

Tesla brought in $25.2 billion in total revenue for Q4 2023, a year-over-year increase of 3 percent. Gross profits were down 23 percent for the quarter year over year, although net income (as determined by generally agreed accounting principles) increased 115 percent year over year. In large part, this was due to Tesla recording a “one-time non-cash tax benefit of $5.9 [billion] in Q4 for the release of valuation allowance on certain deferred tax assets”; non-GAAP income dropped 39 percent.

Free cash flow increased by 33 percent for the quarter, but its operating margin is almost half that of Q4 2022 at 8.2 percent.

For the entirety of 2023, total revenues stood at $96.8 billion, of which $82.4 billion came from automotive revenues, a 15 percent increase compared to 2022. Net profits for the year were 19 percent higher than 2022, but its margin for the year fell from 16.8 percent in 2022 to 9.2 percent in 2023, and for the year, free cash flow dropped by 42 percent.

The Model Y is responsible for much of the company’s success in 2023—Tesla normally does not break out sales or deliveries between the Models 3 and Y, but revealed in its results slideshow that it delivered 1.2 million Model Ys last year, meaning that it also delivered about 500,000 Model 3. Plenty of price cuts helped make that happen in the US, Europe, and China.

Tesla Revenues

Annual Revenues in $ millions:

Loading..........

The Data is Not Available

Source: Tesla IR