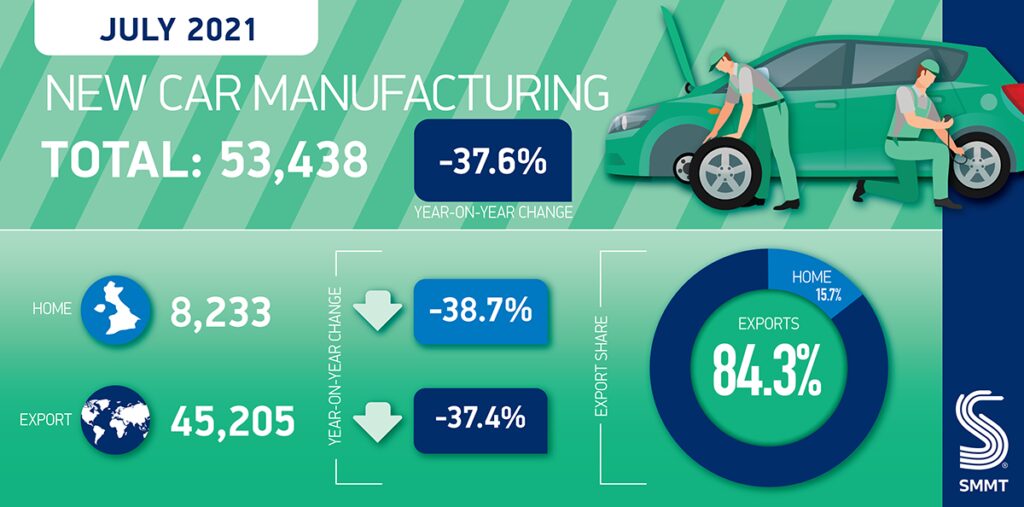

The SMMT reports that new car production in the UK slid by 37% in July to a new low of just 53,438 vehicles.

It represented the worst July performance since 1956 as manufacturers grappled with the global shortage of semiconductors and staff absence resulting from the ‘pingdemic’, with some altering summer shutdown timings to help manage the situation.

The July production for the UK market declined -38.7% to 8,233 while manufacturing for export also fell, down -37.4% with 45,205 cars shipped overseas. Exports accounted for 85% vehicles built in the month as buyers around the world continued to be attracted to the wide range of high-quality cars made in Britain, including the latest alternatively fuelled models.

More than a quarter (26.0%) of all cars made in July were either battery electric (BEV), plug in hybrid (PHEV) or hybrid electric (HEV), their highest share on record, and meaning that UK car factories have turned out 126,757 of these important products since the start of the year.

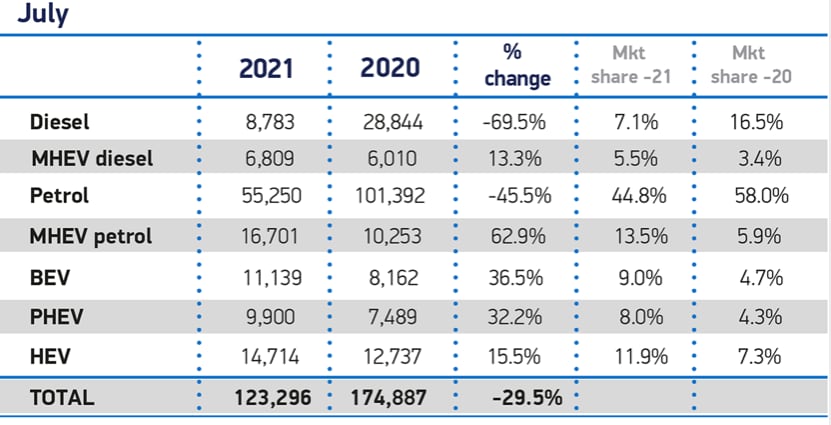

July Registrations

July sales totalled 123,000 new cars a 30% drop from the 175,000 in July 2020. From the start you can see that Diesel sales have fallen off a cliff with just 7% of the market that is now less than the Battery powered cars of pure EVs that sold over 11,000 units.

If you lump the pure EV that are called BEV with the Plug In Hybrids and the so called Mild Hybrids together they represent 48% of the market. Petrol and Diesel combined take 52%. It won’t be long until BEV and Hybrids are the majority.

Chips out

The chip shortage has slowed car assembly lines across the globe because new vehicles often include dozens of semiconductors.

The dearth is not only putting pressure on carmakers but also on tech companies and the consumer electronics sector, which are also competing for supply.

Up to $20 billion could be wiped off global carmakers’ operating profits in 2021 because of the chip shortage, Goldman Sachs said.

Carmakers across the globe are suffering. The supply-chain challenges cut short a run of positive profits for Jaguar Land Rover owner Tata Motors, which posted a bigger than expected net loss for the quarter that ended in June after warning last month that deliveries in the current quarter would be about 50 per cent lower than planned.

In Germany, Volkswagen’s Wolfsburg plant – the world’s largest car factory, employing about 60,000 people – restarted from its traditional summer with only one shift.

Meanwhile, Audi extended the summer break at its two factories in the country by a week. Toyota warned this month it was suspending output at 14 plants across Japan, slashing production by 40 per cent because of supply disruption including chip shortages.

Big Picture

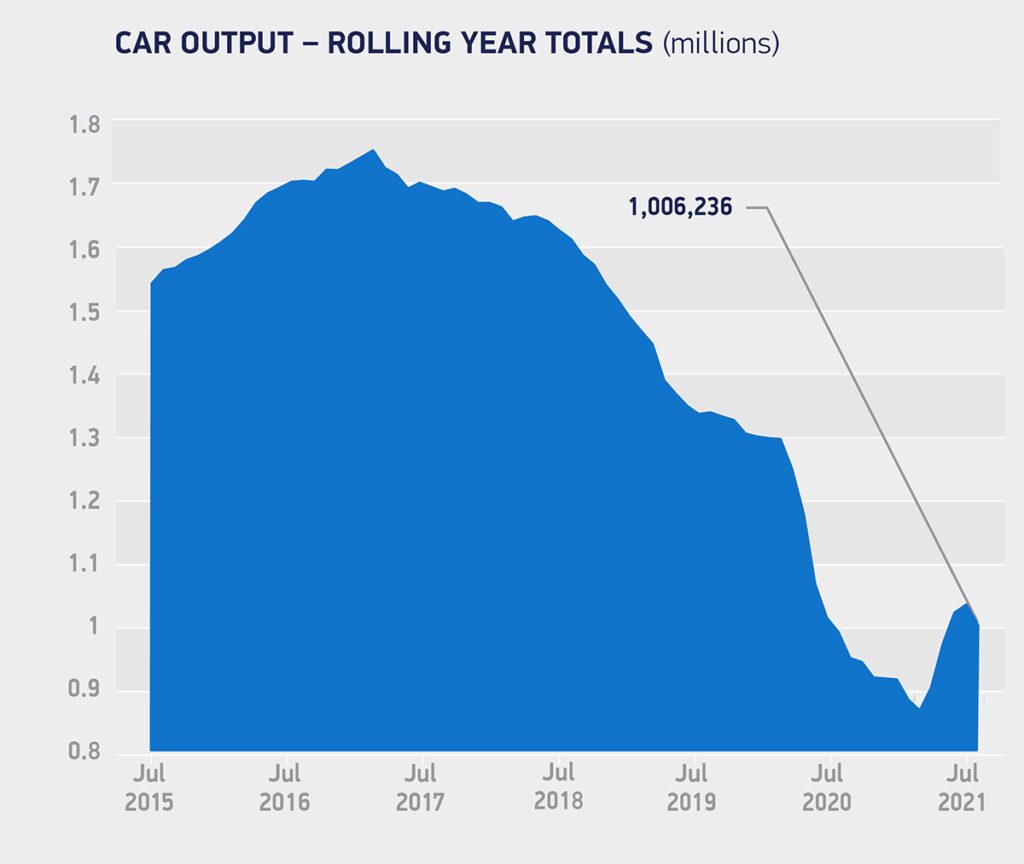

Looking at the rolling annual output we can see that UK car production is grim news for the country and the tax man.